From Smith to Yellen the existence of these three fundamentals was never threatened. Yet the relationship between the three has altered somewhat in recent years. This is the argument of Belgian economist Jan Eeckhout.

One might begin the journey into capital, profits and wages with a helpdesk worker called Erin. Erich was, despite having numerous degrees, squeezed into an open-plan office until the Coronavirus pandemic hit her workplace. Erin works around forty hours a week, thus making $480.- a week, or $23,000 a year. The U.S. Census Bureau lists the annual real median personal income at $35,977 in 2019.

For many workers in many countries wages have stagnated since the 1980s. With the election of Thatcher (44%) in the UK in 1979 and Ronald Reagan (51%) in the USA, the year 1980 marks the beginning of a sustained colonization of society by neoliberalism. One of neoliberalism’s key goals is the destruction of trade unions and the weakening of workers leading to widespread wage stagnation.

1980 also marks the year when wages and productivity parted company. Until that year, both rose together. An analysis by the US Bureau of Labor Statistics distinctly shows that since 1980 there has been a clear break between the evolution of worker productivity and that of wages for most workers. In other words, workers are getting a smaller share of the pie – just as neoliberalism has set out to do. As workers’ productivity increased but wages stagnate, they’re walking fast and moving backward.

This also means there is an ever-increasing rise in wage inequality. Top earners have increased their income while workers at the bottom half have not experienced such gains. Even unhealthier is the fact that the top 1% worker now earn on average twenty times more than the bottom 99% workers in the same firm. Neoliberalism has vacuumed wealth upwards. This is camouflage through, for example, the all boats rise and the trickle down ideology. In fact,

The labor share, the total expenditure on wages as a share of production in the economy has historically been around two-thirds, or 65%. The remaining one-third is expenditure on capital and profits. Today the labor share is below 58%. A decline of 7% [this] may seem tiny, but that includes the salaries of all those top earners, not just the low-paid workers.

While we are daily sold the ideology of competition, in reality there are many sectors of the economy where oligopolies or even monopolies reign:

+ online shopping is monopolized by Amazon;

+ social online relationships by Facebook;

+ online work meetings by Zoom;

+ online auctions are run by eBay;

+ computer software comes from Microsoft, etc.

In short, it is an entrepreneur’s dream to be a monopolist, the only firm active in the market. Without competition, the monopolist sets a price that maximizes profits. Correspondingly, when only a small number of firms compete, then the market is an oligopoly.

Back at the monopoly, the actual board game of Monopoly was designed in 1903 by Elizabeth Magie as a pedagogical device to illustrate the perils of monopoly. Of course, there is ample evidence of the market power of monopoly. There are also extremely outstanding examples like the Mylan company that produces an anti-allergy device that sells for $609.- – the estimated production cost being $35.

Of course, the profit is not going to workers. It goes to shareholders. This creates the profit paradox: the success of thriving firms is not beneficial for workers. We can see this in dark-satanic-mill-like working conditions of Amazon warehouses for example. The entire setup applies even more to wages where Amazon, pays a little above minimum wage while Jeff Bezos’ net worth is at $195.3 billion.

When taxation enters the picture, things getting even worse, as Warren Buffett acknowledged openly when saying that he pays less tax than his secretary. Meanwhile, in order to reduce a firm’s tax base, accountants will book many costs (for example, the CEO’s private jet). In other words, Jeff Bezos’ private jet is tax deductible while the Amazon warehouse worker pays a goods and service tax even on the bus ticket that gets him to Jeff Bezos’ warehouse. Capitalism and a pro-business state can hardly get any better.

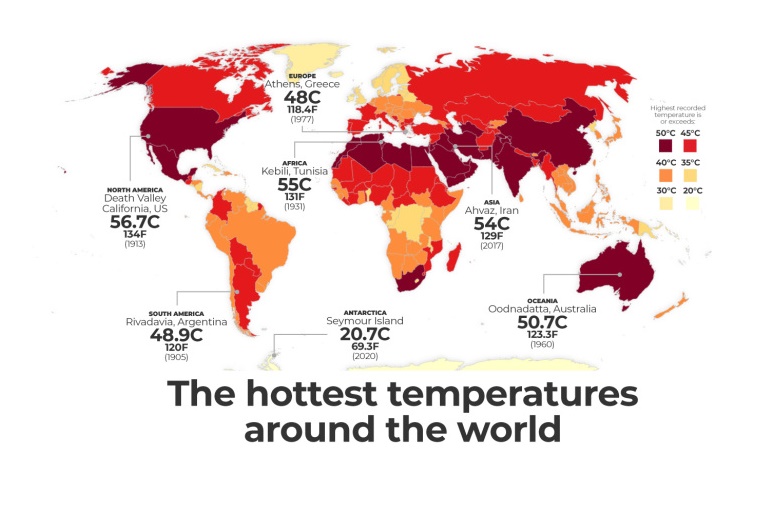

The fattening up of capitalism is observed around the world as the labor share of global wealth has been falling substantially since the 1980s. Much of this is the result of the rise of power of companies and corporations. This power comes to them through neoliberal governments. It is accompanied by a deliberately engineered decline of the power of the worker that came with the destruction of trade unions.

What we see is that market power does not simply redistribute funds from the pockets of the workers to those of the owners of the firm. Market power and the decline in the labor share destroy value in the economy. The central thesis of much of this is:

+ A firm with market power for the goods it sells does take one fundamental step back. Because it sells at higher prices, it sells less and it produces less. Therefore, that firm reduces the number of workers it hires. If market power is widespread in the economy, and there are many dominant firms in all sectors, then the small step back becomes a giant leap backward that drives wages down in the entire economy.

+ If one trucking company hires fewer drivers, drivers’ wages are unaffected because they can drive trucks and cars for other companies, they can work in the food industry, in security, in construction, and so on. But if there is market power in many firms in all industries, then the economy-wide demand for labor falls and, as a result so do wages in all industries.

+ If one locust lands and eats at the crop, there is no loss to the farmer’s yield. If a swarm of locusts lands on the field, the crop disappears entirely.

This has dire consequences. For example, labor now accounts for 59% of GDP and profits account for 12%. In the 1970s those numbers were 65% and 3%. In other words, wealth has been vacuumed upward since the advent of neoliberalism in the 1980s. Critically, wages of the low earners have stagnated in dollar terms and have decreased as a share of GDP.

This means that poor are made poorer. It also means that their wealth is declining in relation to the overall wealth of a society when this is measured against GDP: the value added created through the production of goods and services in a country during a certain period.

Even more dismal, since the 1980s the weekly wage of the median worker has barely moved while over the past forty years, GDP has nearly doubled. The median wage as a share of GDP has nearly halved. The overall picture of wage stagnation of the low-income earners is therefore much more dire. As planned by the advocates of neoliberalism, the poorer you are the more you are hit – the richer you are already, the richer you have been made during the last 40 years of neoliberalism.

We are not moving closer at all. Instead, we are moving further apart as society are further and further split into rich and poor. Neoliberalism damages a convex society in which the middle-class is strong and the bottom (the poor) and the top (the rich) are a few.

Instead, neoliberalism creates a concave society with a shrinking middle-class while giving to the already rich and pushing the poor further down. As a consequence, we produce more wealth every day but get less of it. We work harder only to get less.

Meanwhile at the top end of the income scale, competitive pressure raises the compensation of all CEOs, and no firm is better off for it. In many cases, CEO pay, perks, golden parachutes, corporate jets, etc. have next to no link to profitability, value of a corporation, and corporate success – performance related pay exists mostly for those further down the chain.

Yet CEO pay is linked to a CEO’s ability to create a monopoly. Moreover, the rise in CEO compensation goes hand-in-hand with the rise in market power. Firms with more market power pay their executives more. This leads us to the conclusion that executive salaries are not only high, but excessive.

Many of these excessively overpaid CEOs can’t be found on the front pages of glossy magazines. Most CEOs shy away from the limelight. Plenty of well rewarded CEOs tend to be financial managers and owners of private equity firms.

In 2004, Eddie Lampert became the first Wall Street manager to make more than $1 billion in one year. In real numbers, this is: $1,000,000,000. The average price for a new car in the USA is $40,000 which means, Mr Lampert’s $1bn could have bought him twenty-five-thousand new cars.

Even unhealthier is the fact that, the increase in the average total income of the top 1% between 1980 and 2018 is 217%. During that same period, wages of the median workers have stagnated. This too shows that the rich are made richer while the rest stagnate. And this is even the case when one looks inside companies where wages of workers and rewards of CEOs grows every more disconnected even when the stratospheric money paid to CEOs is a reward for questionable business practices.

These are found in the Nestle’s baby formula case, the Ford Pinto, Richardson-Merrell’s Thalidomide, Exxon Valdez, Bhopal, BP’s Gulf of Mexico, Volkswagen’s emissions, Enron – the list is endless. But corporations don’t need to worry as long as ideologies like corporate social responsibility and business ethics are able to convince the public that all is fine.

As it is so often the case, behind every great fortune there is crime, from John D. Rockefeller’s Ludlow massacre to the Sackers billionaires and the estimated 72,000 overdose deaths in 2017 in the United States alone. Yet, some of the rich and wealthy seek to buy their way out of their crimes by giving donations and by philanthropy.

They do this undeterred by the fact that the result is that donation fail to target those in society who need it most. But most importantly, donations are not free; the $1 million donation to Harvard cost the taxpayer $350,000 if the donor pays a 35% marginal tax rate. The total amount of foregone tax income is in the order of $50 billion per year.

In other words, philanthropy comes with a double whammy. Rich individuals, companies and corporations save truckloads of taxes. Meanwhile, corporate public relations based on philanthropy makes the rich and their corporations look good. Meanwhile, taxpayers and society foots the bill – an ingenious setup that systematically engineers inequality.

Yet despite the decline in inequality worldwide, income inequality within each of these groups of countries has increased. At the same time, income inequality within Western countries went up as well. In other words, there is more inequality within our own economies at home and in adjacent neighborhoods, and less inequality between economies far away. Likewise, income inequality in larger cities has started to rise since 1980 – the year neoliberalism started to make a showing.

Inequality shows up in evermore ways. Since the 1980s, the Dow Jones, adjusted for inflation, has been growing at an average rate of about 6.2% per year. It wasn’t always like that. In 1981, the inflation-adjusted index was at the same level as it was after World War II in 1946, or zero-real growth over that thirty-five year period. This shows that since 1980, big- and not-so big business has thrived while many others did not thrive.

Those who did not thrive are workers. Today, a typical worker is hit twice: her wages are lower due to lower labor demand, and what she consumes is sold at monopolistic prices, further lowering her purchasing power. And if this is not enough, the worker is hit a third time because she holds no stocks and therefore forgoes the financial gains of market power.

These are just three ways in which neoliberalism makes to poor poorer and the rich richer. Of course, this is accelerated in an economy in which the immediate effect of robots and automation is to make workers poorer and firms richer and not only are made richer firms, their shareholders and CEOs are getting richer too.

For the rest, things are made worse and worse. For example, the skilled miner who becomes an Uber driver or a security guard is likely to earn only a few dollars more than minimum wage. In the so-called gig economy, most drivers work fewer than ten hours per week and only 19% work full-time. Many workers report to be willing to accept lower wages in exchange for flexibility.

This may well continue until the driverless car appears. When automation replaces workers and when robots increase productivity with fewer workers, the displaced jobs disappear permanently. What might also disappear permanently is democracy, as the Slovenian philosopher Žižek argues.

In the end one might like to look at US Supreme Court Justice Louis Brandeis who said, Americans might have democracy or wealth concentrated in a few hands, but they could not have both. For corporate capitalism, democracy is merely an add-on, an unwarranted and disturbing feature at best.

Neither companies and corporations nor corporate capitalism has ever needed democracy. Within companies and corporations, democracy has been extremely eliminated. In fact, there is no industrial democracy.

In international institutions that govern global trade, commerce and globalized capitalism, democracy has also been eliminated. Yet in some – and by no means all – countries, companies, corporations and corporate capitalism are forced to deal with democracy. In those countries, the current institutions ensure that capitalism is pro-business.

The prime institution to achieve a suitable level of pro-business democracy are corporate media. This seems to continue until capitalism has turned our planet into The Uninhabitable Earth.

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________